Some Known Facts About Bankruptcy Law Firm Tulsa Ok.

Table of ContentsNot known Details About Bankruptcy Attorney Tulsa Tulsa Bankruptcy Consultation Can Be Fun For EveryoneThe Of Top-rated Bankruptcy Attorney Tulsa OkHow Tulsa Ok Bankruptcy Specialist can Save You Time, Stress, and Money.The Single Strategy To Use For Best Bankruptcy Attorney TulsaExcitement About Tulsa Debt Relief Attorney

People should make use of Chapter 11 when their financial debts go beyond Chapter 13 debt limitations. It hardly ever makes sense in other circumstances yet has much more options for lien stripping and cramdowns on unsecured sections of secured car loans. Phase 12 bankruptcy is designed for farmers and anglers. Phase 12 settlement plans can be a lot more versatile in Phase 13.The methods examination looks at your typical month-to-month revenue for the six months preceding your filing day and compares it against the median income for a similar home in your state. If your revenue is listed below the state typical, you automatically pass and do not need to finish the entire type.

The financial debt restrictions are noted in the chart above, and current quantities can be confirmed on the U.S. Judiciaries Phase 13 Bankruptcy Essential page. Find out more about The Means Test in Phase 7 Personal bankruptcy and Debt Purviews for Chapter 13 Personal bankruptcy. If you are married, you can apply for insolvency collectively with your spouse or independently.

Filing personal bankruptcy can help a person by disposing of financial obligation or making a strategy to pay off debts. A personal bankruptcy situation generally begins when the debtor files a petition with the bankruptcy court. An application might be submitted by a private, by spouses together, or by a corporation or other entity. All insolvency cases are managed in federal courts under policies laid out in the U.S

The 2-Minute Rule for Tulsa Bankruptcy Filing Assistance

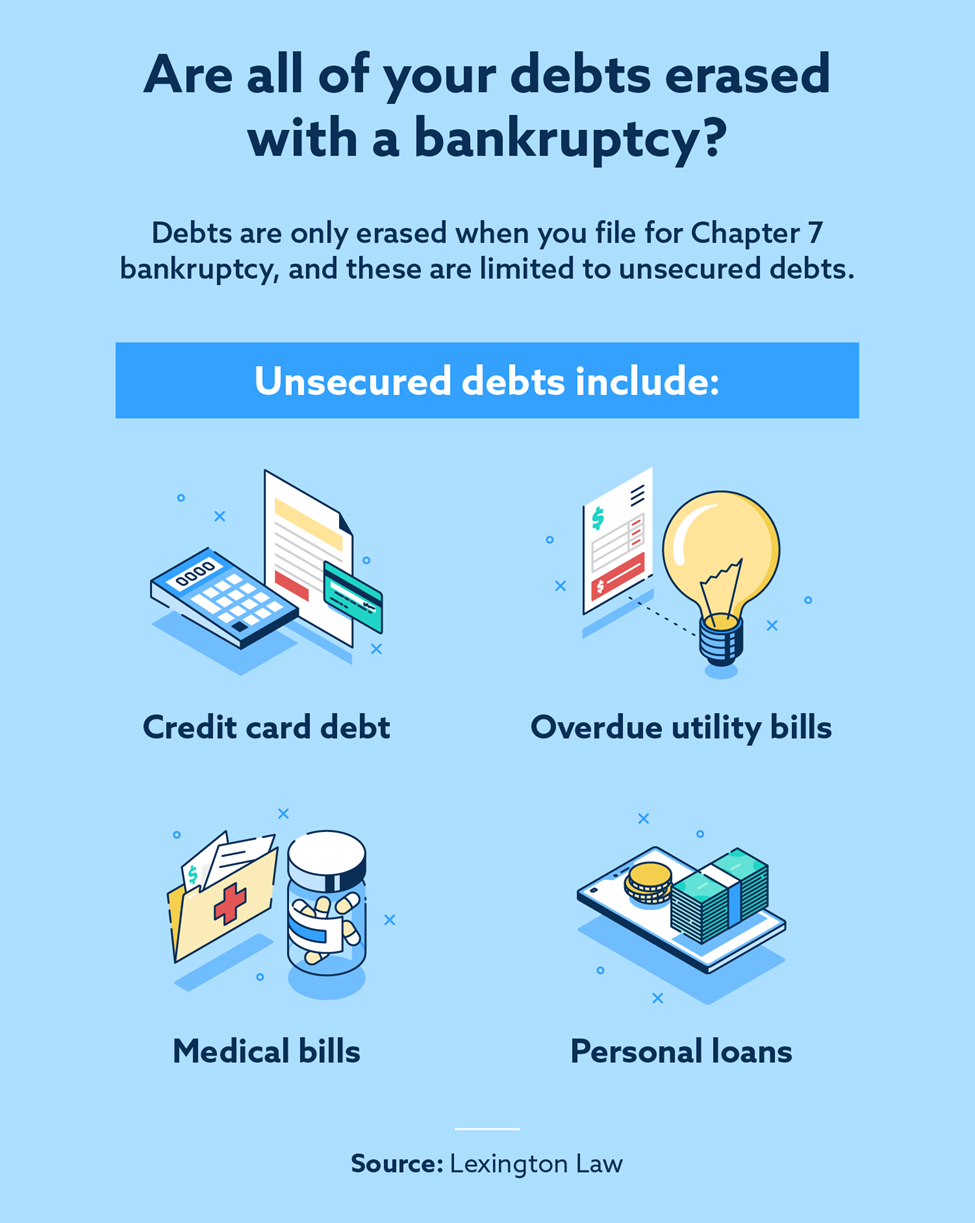

There are different types of insolvencies, which are typically described by their chapter in the united state Bankruptcy Code. Individuals may submit Phase 7 or Phase 13 insolvency, depending on the specifics of their circumstance. Municipalitiescities, towns, villages, exhausting districts, community energies, and school districts may file under Phase 9 to reorganize.

If you are facing monetary challenges in your personal life or in your business, chances are the idea of declaring bankruptcy has actually crossed your mind. If it has, it also makes sense that you have a whole lot of personal bankruptcy questions that require responses. Lots of people in fact can not address the inquiry "what is personal bankruptcy" in anything other than general terms.

If you are facing monetary challenges in your personal life or in your business, chances are the idea of declaring bankruptcy has actually crossed your mind. If it has, it also makes sense that you have a whole lot of personal bankruptcy questions that require responses. Lots of people in fact can not address the inquiry "what is personal bankruptcy" in anything other than general terms.

The smart Trick of Chapter 13 Bankruptcy Lawyer Tulsa That Nobody is Talking About

Chapter 7 is called the liquidation insolvency phase. In a phase 7 insolvency you can remove, erase or release most sorts of financial debt. Instances site web of unprotected debt that can be eliminated are credit rating cards and medical costs. All kinds of people and business-- individuals, couples, companies and partnerships can all submit a Chapter 7 insolvency if eligible.

Many Chapter 7 filers do not have much in the method of possessions. They might be occupants and own an older cars and truck, or no auto at all. Some cope with moms and dads, good friends, or siblings. Others have residences that do not have much equity or are in significant requirement of repair.

Lenders are not permitted to pursue or preserve any type of collection activities or legal actions during the situation. A Chapter 13 insolvency is extremely powerful because it supplies a mechanism for borrowers to stop foreclosures and sheriff sales and stop foreclosures and utility shutoffs while capturing up on their safeguarded debt.

10 Easy Facts About Affordable Bankruptcy Lawyer Tulsa Shown

A Phase 13 instance might be beneficial because the borrower is permitted to obtain caught up on mortgages or vehicle loan without the hazard of foreclosure or repossession and is enabled to keep both excluded and nonexempt building. The borrower's strategy is a file describing to the bankruptcy court just how the borrower recommends to pay current expenses while paying off all the old financial debt equilibriums.

It offers the borrower the chance to either sell the home or become caught up on home mortgage repayments that have actually fallen back. An individual filing a Phase 13 can propose a 60-month plan to cure or come to be existing on mortgage repayments. For circumstances, if you fell back on $60,000 worth of mortgage payments, you might suggest a plan of $1,000 a month for 60 months to bring those home mortgage settlements existing.

It offers the borrower the chance to either sell the home or become caught up on home mortgage repayments that have actually fallen back. An individual filing a Phase 13 can propose a 60-month plan to cure or come to be existing on mortgage repayments. For circumstances, if you fell back on $60,000 worth of mortgage payments, you might suggest a plan of $1,000 a month for 60 months to bring those home mortgage settlements existing.

6 Easy Facts About Tulsa Bankruptcy Attorney Described

Sometimes it is better to avoid insolvency and resolve with financial institutions out of court. New Jersey also has Learn More a different to insolvency for companies called an Job for the Benefit of Creditors and our law office will look at this option if it fits as a prospective approach for your business.

We have produced a tool that helps you choose what chapter your data is most likely to be filed under. Visit this site to make use of ScuraSmart and learn a feasible option for your financial obligation. Many individuals do not understand that there are numerous sorts of bankruptcy, such as Chapter 7, Phase 11 and Chapter 13.

Here at Scura, Wigfield, Heyer, Stevens & Cammarota, LLP we take care of all sorts of bankruptcy situations, so we have the ability to answer your insolvency questions and aid you make the very best decision for your case. Here is a brief take a look at the financial obligation relief alternatives available:.

Getting The Bankruptcy Attorney Tulsa To Work

You can just submit for insolvency Prior to declaring for Phase 7, at least one of these ought to be real: You have a lot of financial debt earnings and/or assets a lender might take. You have a lot of debt close to the homestead exemption amount of in your home.

The homestead exception quantity is the greater of (a) $125,000; or (b) the region median price of a single-family home in the preceding fiscal year. is the quantity of cash you would certainly maintain after you sold your home and paid off the home mortgage and various other liens. You can locate the.

Comments on “Not known Incorrect Statements About Bankruptcy Attorney Near Me Tulsa”